NATHAN GUMA

THE International Monetary Fund (IMF) says rampant corruption poses risks to Zimbabwe’s macro-economic performance and must be urgently addressed.

It says the country needs structural reforms to improve the business climate, strengthen economic governance, and to alleviate corruption vulnerabilities.

This follows the recent IMF Staff Article IV Consultation mission to Zimbabwe led by Wojciech Maliszewski from 18 to 27 June.

Zimbabwe’s economic governance, the IMF says, has significant weaknesses and corruption jeopardises the macro-economic situation.

Addressing these weaknesses remains key for promoting sustained and inclusive growth, it says.

In a statement, the IMF says: “Despite headwinds, Zimbabwe’s economy continues showing resilience. Growth is expected to decelerate to about 2 percent in 2024 (from 5.3 percent in 2023), as the country faces a devastating El Niño-induced drought. Higher import bills are also worsening the balance-of-payments outlook. But growth is expected to recover strongly in 2025 to about 6 percent, supported by a rebound in agriculture and ongoing capital projects in manufacturing.

“Against this background, the Reserve Bank of Zimbabwe (RBZ) introduced in April 2024 a new currency—the Zimbabwe Gold (ZiG). T he ZiG official exchange rate has so far remained stable, ending a bout of macroeconomic instability in the first 3 months of the year (when the Zimbabwean dollar depreciated by about 260 percent). Assuming that macro-stabilization is sustained, cumulative inflation in the remainder of the year is projected at about 7 percent.” The IMF adds:

“The mission welcomes improvement in monetary policy discipline and recommends further refinements to the policy framework. Price stability would be best achieved by stabilising the ZiG nominal exchange rate against a suitable basket of currencies (accounting for the dominant role of the USD in the economy). This could be in turn accomplished by controlling base money growth: for now through unremunerated Non-Negotiable Certificates of Deposits (NNCDs), but over time through indirect (interest-rate-based) monetary instruments to increase the attractiveness of the new currency. The exchange rate should be determined in a deeper market to provide relevant information in the decision regarding the monetary policy stance, which would require identifying and removing any remaining impediments to the functioning of the FX market to promote price discovery.”

The IMF says the fiscal financing must be managed in a sustainable manner.

“Closing the fiscal financing gap is essential to sustainably stabilise the currency. The transfer of past debt obligations related to the RBZ’s quasi-fiscal operations (QFOs) to the Treasury represented an important step to strengthen financial discipline.

“The mission also welcomes enhanced coordination between the RBZ and the Ministry of Finance, Economic Development and Investment Promotion (MoFEDIP) on macro-policies and liquidity management.

However, the mission assessed that the cost of servicing the QFO-related debt and T-bills (including about 8 percent of GDP issued last year), combined with weaker-than-expected revenues (despite strong efforts to raise them through policy measures) and drought-related spending, opened a sizeable financing gap in the 2024 budget.

“The financing gap would need to be closed in a way that does not undermine the monetary policy stance. The mission is encouraged that the work to identify such measures is ongoing and stands ready to provide support to the authorities as needed.”

The IMF says the Mutapa Investment Fund will be key to economic stabilisation, but must be clearly defined, transparent and accountable.

“Strengthened governance framework for the newly constituted Mutapa Investment Fund will be key for the stabilisation effort.

Steps to this end should include ensuring that the fund’s mandate is clearly defined and aligned with the National Development Strategy; enhancing its transparency and ensuring full integration in the budget process (Mutapa’s annual operating budget, capital investment, asset sales, and borrowing plans should be subject to approval by the MoFEDIP — financial management of public entities is already regulated by the Public Finance Management Act); and adhering to highest standards of corporate accountability,” it says.

“The mission discussed structural reforms aimed at improving the business climate, strengthening economic governance, and reducing corruption vulnerabilities. Zimbabwe’s economic governance has significant weaknesses and corruption poses risks to macroeconomic performance. Addressing these weaknesses remain key for promoting sustained and inclusive growth.”

On debt resolution, the IMF says international re-engagement remains the best option.

“International re-engagement remains critical for debt resolution and arrears clearance, which would open the door for access to external financing. The authorities’ re-engagement efforts, through the Structured Dialogue Platform, are key for attaining debt sustainability and gaining access to concessional financial support. In this context, the mission encourages the authorities to continue adhering to high standards of public debt transparency, including through the inclusion and appropriate treatment of recently issued debt in its public and publicly-guaranteed debt statistics.”

“The IMF maintains an active engagement with Zimbabwe and continues to provide policy advice and extensive technical assistance in the areas of revenue mobilisation, expenditure control, financial supervision, debt management, economic governance and anti-corruption, and macroeconomic statistics.

“However, the IMF is currently precluded from providing financial support to Zimbabwe due to its unsustainable debt situation — based on the IMF’s Debt Sustainability Analysis (DSA) — and official external arrears. “An IMF financial arrangement would require a clear path to comprehensive restructuring of Zimbabwe’s external debt, including the clearance of arrears and a reform plan that is consistent with durably restoring macro-economic stability; enhancing inclusive growth; lowering poverty; and strengthening economic governance.”

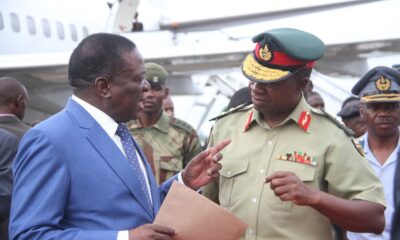

The IMF staff held meetings with minister of Finance, Economic Development and Investment Promotion Professor Mthuli Ncube; deputy minister of Finance, Economic Development and Investment Promotion, David Mnangagwa; and permanent secretary George Guvamatanga; Reserve Bank of Zimbabwe governor John Mushayavanhu; Martin Rushwaya, Chief Secretary to the President and Cabinet; other senior government and RBZ officials; members of Parliament; and representatives of the private sector, civil society, and Zimbabwe’s development partners.