By Brett Chulu

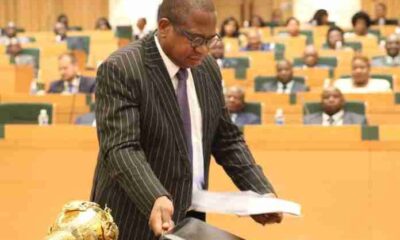

THE first of five national budgets underpinning the National Development Strategy One (2021-2015)(NDS1) was unveiled in Harare yesterday.

Globally, it is a ZW$421.6 billion financial commitment, translating to US$5.27 billion (at the 2021 official average exchange rate forecast by Treasury) or US$3.5 billion (grey market rates). The budget is to be funded through expected fiscal revenues amounting to ZW$390.8 billion and Treasury Bills financed deficit to the tune of ZW$30.8 billion. Treasury projects a nominal Gross Domestic Product (GDP) for 2021 of ZW$2.4 trillion or US$29.9 billion. This means a budget deficit of 1.3% is expected, well below the NDS1 target of 2% of GDP.

The article looks at the merits and demerits of the 2021 National Budget.

Merits

First, the budget cannot be flawed for reinforcing commitment to stay the course of fiscal discipline, making sure the government lives within its means, obviating recourse to monetising the deficit that would feed the inflation dragon.

The planned budget deficit, at 1.3% of GDP, is significantly below the Sadc Macro-economic Convergence target of 3%. The National Budget pledges zero recourse to borrowing from the central bank to plug the projected budget hole. A budget is a commitment—it remains to be seen if the commitment to maintain fiscal discipline will materialise by resisting political pressure to breach fiscal limits.

Second, the promise made in the NDS1 to adopt programme-based budgeting (PBB) has been made good.

The structure of the Budget is organised around NDS1 priority areas, a commendable departure from earlier budgets that were focused on allocating funds collected by the taxpayer to government departments and agencies. To a large extent, the 2021 budget clearly indicates the activities being funded and how much is being allocated towards those resources.

To ensure that allocated funds are used for the purpose indicated, responsible government departments and agencies will be required to draft strategic plans to be implemented via the Integrated Results-Based Management framework, supported by secretary performance contracts.

It is a good aspiration. We await the translation of intention into action.

Third, there is a fairly good attempt to support value-addition development strategies through taxation.

To support the transformation of the agriculture value chain, a fertiliser manufacturers’ rebate has been introduced. Exemption of sugar from the General Import Licence has been effected in order to enhance the competitiveness of value-added products that heavily depend on sugar as a key ingredient. The suspension of waiver on duty for importation of cars by government departments is meant to encourage government to source vehicles locally and support the domestic car assembly industry.

Duty-free import of completely knocked down kits has been introduced in order to resuscitate the local car assembly industrial sector. In the same vein, suspension of duty-free certificates for the importation of single-cab and double-cab vehicles will come into effect.

Fourth, the attempt to widen the tax base targeting the informal sector and self-employed professionals is a positive that will enhance revenue collection to contribute towards funding the activities meant to drive the NDS1.

Informal entrepreneurs housed in sub-divided units are a common sight in Zimbabwe’s urban centres; they will be required to pay presumptive tax of US$30 per month, with landlords obligated to collect the tax.

It is not yet clear if this will include flea markets. To focus on this revenue widening plan, a special tax unit focusing on small and medium enterprises will be established.

Fifth, the operationalisation of the Sovereign Wealth Fund, another proposal made in this column, has been backed by seed capital of about US$10 million. We already have an Act of Parliament authorising the Sovereign Wealth Fund. The National Budget must be commended for kick-starting the operation of the Sovereign Wealth fund.

Demerits

First, there is ambiguity in terms of the programme-based budgeting and the departmental or functional monetary allocations. Both programmatic budgets and functional budgets were presented with the two being practically similar in terms of totals. We know from a functional perspective there are administrative costs involved.

This means a significant amount of money will not be for the strategy-critical activities.

The budget did not attempt to specify how much of the allocation to a government department is for NDS1 activities and what is for administrative support. This ambiguity must be promptly addressed.

Second, for some key activities, no monetary value was attached. We learned from the budget that the name of the promised land bank is the Land and Agricultural Development Bank of Zimbabwe (LADBZ).

We were told the bank will be capitalised in 2021 but the budget did not specify how much has been set aside.

The same goes for the warehouse receipting system—the budget indicates government will be involved but does not specify the monetary implications.

The introduction of the agricultural commodity exchange is expected to take shape in 2021 as per the budget. However, the fate of the Grain Marketing Board is not spelt out. It would seem there are some key activities that are still in the works for which financial commitments are not yet clear.

Third, the budget breeds confusion with regards to production forecasts for cereals. It mentions that 1.8 million households are expected to produce 3.6 million tonnes of cereals yet the table for forecast for 2021 sets maize production at 1.6 million tonnes.

Erroneously, the budget states that production from 1.8 million households under the Pfumvudza/Intwasa programme is two tonnes per hectare. The correct position is two tonnes on two-sixteenths of a hectare, translating to a pro-rated yield of 16 tonnes a hectare. This is a top productivity rate.

This is a national opportunity the budget should have invested more attention in by asking how such a top productivity rate could be maintained by extending production to one hectare, at the minimum. Funds should have been allocated to establish research and development to develop local solutions to upgrade the one-sixteenth per hectare production.

The potential output from this upgrade will exceed our national maize requirement by over 8 times. The same is possible for oil seeds. The potential for an agro-export-oriented agricultural production via simple upgrades is possible; the budget exhibits hesitation in exploring this huge potential.

Last, the gross capital formation for 2021, at 9.45% of GDP, indicates that we have a very low ambition. It is a big indictment on us a nation that more than 70% of this gross capital formation is coming from the government. Clearly, the private sector is not coming to the party in terms of investment in capital goods. Questions need to be asked as to why the private sector is unable to play a significant role in shoring up capital formation.

We expect capital formation rates to be above 20% of GDP, with the private sector accounting for the bulk of the investment. It is clear the budget is reflecting a very low national ambition. Private sector-led growth is proving to be a hollow mantra.

Brett Chulu is a management consultant and a classic grounded theory researcher who has published research in an academic peer reviewed international journal. He can be contacted through email: [email protected]