TREASURY witnessed a 4% decline in corporate tax for the 2020 budget revenue head contributions, a move attributed to uncollected tax due to tax holidays and incentives to corporates, most of which are Chinese mining companies that are being allowed to mine for up to five years without paying tax, civil society organisations report.

MARY MUNDEYA

This is contained in a Citizen’s Guide to the 2021 National Budget and the Zimbabwe Coalition on Debt and Development (Zimcodd).

In 2019, corporate tax contributed 13% to the budget whereas in 2020 it declined to 9%.

In its quest to attract local and foreign direct investment, the government of Zimbabwe is offering various tax incentives to investors, locating their business in special economic zones, a move that citizens described as regressive during the 2022 National Budget consultations.

Businesses in the special economic zones are exempt from duty on goods and equipment that are consumed in establishing the business for the first five years and have a 15% tax rate thereafter.

On 27 January this year, the government through Statutiry Instrument 26 of 2021 granted Great Dyke investment (GDI), a platinum-mining company, a five-year tax exemption commencing from the date of receipt of income from mining operations and sales of mining inputs.

Chinese telecommunications giant Huawei Technologies was also exempted from paying income tax dating back to 2009.

Expressing sheer frustration with the way the government is offering countless tax exemptions to companies while burdening citizens with countless taxes, Simukai Rural Residents Trust’s representative Masimba Manyanya said it is a worrying development.

“As a nation we have been told that the country is open for business and industrialising, but now the contradictory message is that we are having a decline in corporate taxes. If Zimbabwe is having more cooperate entities being established in the country, then those companies must be paying taxes. A progressive government will not depend of getting revenue from the value-added tax, which is largely contributed by the poor people. It’s a really sad predicament because if you look at all these mining enterprises being set up by the Chinese, they are not paying tax whilst the poor old lady in the rural areas is paying more tax than the Chinese.”

Manyanya further bemoaned the behaviour of trans-national corporations in poor and developing countries, labelling them as masters of corruption who connive with local ministers to extract wealth, while evading tax and not being involved in any social investment.

“Conglomerates are the masters of corruption, because they have the resources and technical knowhow to create transfer pricing mechanisms and connive with our local ministers to siphon our resources and not even be involved in any corporate social responsibility such as repairing roads,” he said.

Zimcodd said the government should stop granting tax incentives to multi-national companies as this was not in the spirit of tax justice, constitutionalism and progressive taxation in the country.

It said due to such practices, global inequality has increased by 11% in recent years. The United Nations Development Programme indicates that the richest 10% have up to 40% of global income whereas the poorest 10% earn only between 2% and 7%.

“For there to be equality, we argue that there is a need for just and equitable distribution of the tax burden through the introduction of a wealth tax to ensure that the richest pay a fairer share of the resources required to ensure sustainable and inclusive growth,” the civil society group says.

“There is an urgent need for the government of Zimbabwe and other African governments to stop giving out harmful tax incentives to multi-national companies.”

Zimcodd said Zimbabwe is facing very limited fiscal space, while the impact of Covid-19 plus unsustainable debt has crippled the country’s capacity to mobilise resources to provide social safety nets to the vulnerable.

As much as tax exemptions act as sweeteners to allow investors to pump in more capital while cushioning them from huge tax burdens, there are questions as to whether citizens will really benefit from such.

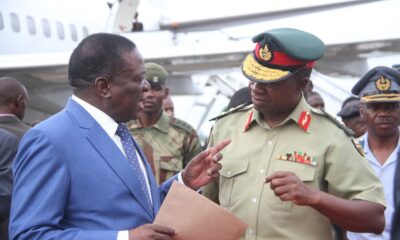

Since the new dispensation came into power in 2017, Zimbabweans have been grappling with different taxes that Finance minister Mthuli Ncube (pictured) introduced under his “austerity for prosperity” mantra such as the 2% tax on electronic transactions, as well as the heavy burden of inheriting the toxic debt arising from failed government programmes such as the scandalous farm mechanisation scheme which offloaded US$1.3 billion onto the shoulders of taxpayers. There is also the crisis of failed state-owned enterprises, such as Air Zimbabwe.