News

China’s state tobacco company is massive at home. Now it’s ready to take over the world

Published

4 years agoon

By

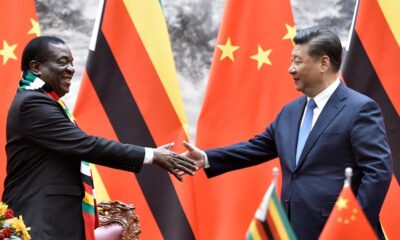

NewsHawksZimbabwe is Africa’s biggest tobacco producer, ranking high up with the world’s leading producers such as China, India, Brazil and the United States, hence part of the global industry. The global tobacco market was valued at over US$932 billion in 2020 and is expected to grow at an annual rate of 1.8 percent from 2021 through 2028.

Alessia Cerantola and Andrei Ciurcanu

IT is the biggest cigarette company you have never heard of. While the China National Tobacco Corporation (CNTC) produces nearly half the world’s cigarettes, almost all of them have been consumed at home. Until recently.

In 2015, state-owned CNTC jumped on China’s “Belt and Road” initiative, a global strategy for developing Chinese infrastructure and trade that built on the country’s “go global” doctrine. The company, which is often simply called China Tobacco, has been aggressively pushing its cigarettes into new markets, and expanding tobacco production in other countries.

“They are looking for global domination and a place in the world,” Judith Mackay, an expert on the global tobacco industry, said. “The dragon is roaring.”

Even though CNTC has grown into the world’s biggest cigarette company, relatively little is known about the secretive giant.

Journalists from Organised Crime and Corruption Reporting Project (OCCRP) and its partners on five continents — including The NewsHawks — decided to investigate CNTC’s activities. They found that the massive conglomerate has pursued a strategy of expansion that is ethically dubious, and sometimes outright illegal.

Working through a dizzying network of subsidiaries, joint ventures, and other companies —some with connections to smuggling networks — China Tobacco has flooded markets illegally with its brands. The company has also been buying favour with consumers through advertising, and by funding community projects at home and abroad — both of which violate China’s commitments to the Framework Convention on Tobacco Control (FCTC), a global treaty overseen by the World Health Organization (WHO).

In its expansion strategies, CNTC has taken a leaf from the playbook of its “Big Tobacco” competitors, according to Mackay, who advises the WHO on implementing the FCTC.

The companies most often referred to collectively as Big Tobacco –– Philip Morris International (PMI), British American Tobacco (BAT), Imperial Brands and Japan Tobacco International (JTI) –– have all been hit over the years with scandals involving smuggling and unethical advertising.

“As a template, you could argue this is just what China is doing now,” said Mackay. “It’s not different from what they’ve learnt from the rest of the world.”

And China Tobacco has done it well. According to a 2019 estimate by its largest competitor, PMI, China Tobacco controls about 45% of the global market of cigarettes and heated tobacco units. That’s a bigger share than PMI, BAT, JTI and Imperial Brands combined.

Because CNTC is wholly state-owned, unlike its Big Tobacco competitors, its success puts the Chinese government in the awkward position of working directly against its own FCTC obligations. But money talks, and China Tobacco is the country’s fourth most profitable company, according to the authors of a 2017 paper published in the journal Global Public Health. The conglomerate supplies as much as 11% of China’s state tax revenues, they found.

China Tobacco’s focus on domestic sales goes a long way in explaining its obscurity in other countries, according to Jennifer Fang, one of the paper’s authors and an expert on the tobacco sector in Asia at Canada’s Simon Fraser University.

“CNTC’s main market remains in China and is not well known overseas beyond the Chinese diaspora,” she said in an email. “I think this is the primary reason it has gone unnoticed by tobacco control researchers, institutions, media, etc.”

But that is changing. For the past few years, Fang and her colleagues have been documenting China Tobacco’s push to go global.

“The deeper we dig, the more we realize how aggressive CNTC has been about its globalisation strategy, as it targets raw materials, products, brand development, and operation,” she said.

When journalists looked into some of these strategies, they found CNTC subsidiaries proliferating around the world. Some are responsible for buying up tobacco leaves and manufacturing cigarettes. Subsidiaries in countries like Brazil and Zimbabwe have become major players in cultivation too — sometimes at the expense of local farmers.

China Tobacco is also forging new markets — often countries where their brands aren’t legally sold. The OCCRP investigation reveals that people and companies connected to CNTC have delivered cigarettes to smugglers to be sold on the black market in Europe and Latin America.

It’s a well-documented strategy that PMI used in Colombia in the 1990s, when its Marlboro cigarettes illegally flooded the market. The government then opted to legalize and tax the PMI brand. These days, Colombia is awash with brands like Golden Deer and Silver Elephant.

“If you want to understand what is happening now, look what happened in the ’80s, and ’90s with the Big Tobacco producers,” said a Colombian customs official on condition of anonymity, as he was not authorised to speak to journalists.

In Italy, an officer with the financial police told OCCRP he suspected that CNTC could be using the same tactic in that country by encouraging the proliferation of inexpensive smokes, which are either smuggled into the country or manufactured there illegally.

The cigarettes are called Regina, “a name related to the Italian tradition, the Italian language,” Cosimo De Giorgi, head of customs for the Guardia Di Finanza, said. He thinks they could be specifically designed to appeal to the local market.

“This could also be a Trojan horse,” he said.

China Tobacco did not respond to an email and phone call requesting comment.

Global Smuggling

Regina and other brands are manufactured in China Tobacco’s only factory in Europe, which sits next to a slow-moving river, surrounded by forest-covered hills about 140km from the Romanian capital, Bucharest.

A company called China Tobacco International Europe Company (CTIEC) owns the factory, and its cigarettes are sold legally around Europe, mostly in duty-free shops at airports.

But the Romanian-manufactured smokes are also smuggled across borders, sometimes using enterprising methods. In one case, reporters uncovered a network of people connected to organized crime, as well as a CTIEC official. They were part of an elaborate scam to avoid taxes by smuggling cigarettes into Italy using a “cloned” shipping container.

First, the smugglers rented a container in the Italian port in Salerno, near Naples, stating that it would be used to ship cigarettes to Libya — thereby avoiding taxes. But instead of doing that, they filled the container with cheap bricks and mattresses that weighed the same as a shipment of cigarettes.

Then they bought another container, painted it the same colour, attached a sticker with the same identification code, and sent it to the CTIEC factory in Romania to be loaded with smokes.

Border guards and customs officials were shown paperwork indicating that this cloned container was legitimate and could be moved back into Italy, in transit to Libya. In reality, the cigarettes inside would be smuggled around Europe and sold —tax free — on the illicit market.

Or at least that’s how it was supposed to go down.

Unfortunately for the smugglers, police got wind of the scam, which Italian prosecutors later called “ingenious.”

Italian police tapped the phones of members of the criminal network. One of the key suspects was a marketing executive from CTIEC, according to case documents obtained by OCCRP. Prosecutors say she had been coordinating for months with the smugglers, who have connections to the Camorra, a Naples-based organised crime group.

“Smuggling is a way to expand the market.” — Daniel Rico, head of the Colombia-based research firm C-Analisis.

Customs data obtained from Italy also shows that seven tons of Chinese cigarettes were smuggled into that country from Ukraine over just two years.

These same brands of cigarettes were among the nearly 500 million exported over the past seven years from the Romanian factory to Ukraine, where none of its brands are legally sold. Some were brought in by companies now under investigation for smuggling.

CTIEC wrote in an email to OCCRP that it had always followed the law, conducted due diligence, cooperated with customs authorities, and taken other measures to combat the illegal tobacco trade.

In addition to European countries, the cigarettes have ended up in conflict zones including Libya, Syria, and Iraq.

Halfway around the world, reporters found another node for smuggling Chinese cigarettes in a free trade zone at the mouth of the Panama Canal, which Colombian crime expert Daniel Rico called “the Disneyland of smuggling.”

Tracing the origin of contraband cigarettes found in Colombia and the US, journalists found a trail of shell companies leading all the way back to CNTC.

Most of the Chinese-manufactured cigarettes that pass through Panama are being moved into South America — even though Chile appears to be the only country on the continent with a legal market for them.

In July 2020, Colombian authorities made a historic bust of Chinese cigarettes, confiscating almost enough for each of the country’s 50 million people to smoke two. They had been manufactured in China and shipped to the free trade zone in Colón, then wound their way through the Caribbean, with stops in Jamaica and Aruba, before finally arriving in the coastal Colombian city of Cartagena.

“Smuggling is a way to expand the market,” explained Rico, who heads the Colombia-based research firm called C-Analisis.

Bumper crops

While CNTC is pushing its cigarette brands around the world, the conglomerate has also been ramping up tobacco production in other countries. China has been cutting back on tobacco cultivation at home, in accordance with its FCTC obligations, and countries like Brazil and Zimbabwe have helped to make up the shortfall.

China Tobacco entered Brazil — the world’s second-biggest producer — in 2002, forming a subsidiary there to buy up leaves and ship them home. In the early 2010s, it formed a joint venture with a subsidiary of an American tobacco-trading giant, which began contracting Brazilian farmers directly.

By 2019, China accounted for more than 19 percent of Brazil’s tobacco exports, valued at almost US$386 million. That figure had grown from just US$12 million worth of Brazil’s tobacco — only 1 percent of exports — in 1997.

Despite growing into one of Brazil’s major tobacco companies, reporters found that CNTC’s joint venture, China Brasil Tabacos Exportadora SA (CBT), has largely flown under the radar of authorities.

In one case, the Pyxus subsidiary that owns 49 percent of CBT was fined for allowing “slave labor” on a farm where it purchased tobacco under contract. (The fines were later cancelled by a higher court.)

In another case, the Pyxus subsidiary was fined for forcing pregnant employees to quit their jobs at a factory where CBT also based its operations.

Authorities told OCCRP that in both cases, they were unaware of CBT’s involvement with the company.

In Zimbabwe, Africa’s biggest tobacco producer, China was the top importer of local tobacco as of 2019, buying at least a third of the country’s entire crop through a CNTC subsidiary.

But farmers there are on the losing end of punitive contracts and a currency exchange system that leaves them struggling with debt and hunger.

Since Zimbabwe’s currency meltdown in 2008, the Central Bank has been unable to obtain enough US dollars to keep the economy afloat. Most people are paid in “near money” tender that can only be used domestically, including scarce bond notes known as “bollars” as well as a local digital currency. Both of them trade at an official exchange rate which is well below of what they are worth on the street.

The CNTC subsidiary Zimbabwe Tian Ze Tobacco (Pvt) Ltd. is required to pay farmers through the Central Bank in a mixture of local quasi-currency and US dollars.

Much of the U.S. dollar payments are eaten up repaying loans for inputs like fertiliser and fuel, which the farmers buy from Tian Ze’s suppliers. The local currency payment, meanwhile, is converted at the hugely overvalued official rate, sapping much of its value.

Stealth and growth

China Tobacco’s companies in Romania, Brazil, Panama and Zimbabwe are just four points in a corporate constellation that stretches across the globe, from North Korea to Switzerland, and Namibia to the United States.

In 2019, it launched China Tobacco International (HK) Company Limited, which is listed on the Hong Kong Stock Exchange, to oversee the global expansion.

Despite its expanding footprint, China Tobacco remains mysterious even to global health authorities overseeing the FCTC.

“Information is very fragmented,” Mackay said.

“We have so little idea, because it’s a state government department and the way it interacts with other state government departments is all behind closed doors. There is no transparency.”

As a 2020 publication funded by PMI’s Foundation for a Smoke-Free World noted, the company was not mentioned even once in the 2019 WHO report on global tobacco use trends. In contrast, the authors pointed out, competitors like PMI and BAT were mentioned 20 times or more.

The WHO declined to comment on questions about China’s compliance with the FCTC.

As the PMI study pointed out, there is an inherent contradiction between China’s pledges to the FCTC to fight smoking and its ownership of the world’s biggest tobacco company. Not only are the fortunes of the government and the company welded together, but they are joined at a policy level too.

China Tobacco shares the same website as the authority in charge of regulating the industry, the State Tobacco Monopoly Administration (STMA). The two ostensibly separate bodies also employ the same personnel.

“In fact, the STMA and CNTC are the same organisation, with two different names,” the authors of a 2012 study by the Japanese Society for Hygiene wrote.

Meanwhile, examples abound of how China violates the FCTC by attempting to attract smokers with advertising and through charitable projects and donations.

“The tobacco industry continues to unleash large marketing campaigns and is still able to expand its consumer base and successfully acquire a new generation of smokers,” the WHO noted in its 2019 report on the global tobacco epidemic.

Chinese state media and even government websites carry articles about good works by CNTC subsidiaries like the China Tobacco Guangdong Industrial Co., Ltd. One press release posted to the Guangdong provincial government website in mid-2020 expounded on the company’s “decisive victory” over poverty in the village of Dengfang.

A resident, “impoverished by illness in his younger years,” received agricultural training that helped him make “the highest income from tobacco planting in the village,” according to the press release.

China Tobacco has also carried out charitable activities overseas, in violation of the FCTC.

The CNTC subsidiary in Zimbabwe engages in a host of projects from reforestation to funding orphanages and schools.

In Cambodia, the company Viniton, which is majority owned by CNTC’s China Tobacco Guangdong Industrial Co., Ltd. and produces the popular brand of Angkor cigarettes, touted its sponsorship of primary schools on its website, until the page was taken down last year.

The company quoted a speech given by Viniton’s general manager, Liu Daoxin, at a primary school.

He said that Viniton “actively contributes to domestic welfare initiatives, especially in the education sector,” and had “consistently provided financial assistance in several varying forms to fund infrastructure and equipment provision for schools and education facilities, helping promote the development of the country’s education sector.”

These are flagrant violations of the FCTC. Although China is a signatory of the convention, documents discovered by OCCRP show that the company made its opposition to the FCTC known in the years running up to the treaty’s launch in 2003.

“To ban any tobacco advertising or to determine the health warning in the package with the same size and content worldwide is unacceptable and is a violation of the legal right of a legal product,” the company wrote in a 2000 submission to the FCTC, which reporters discovered in an online archive at the University of California, San Francisco.

“The health evidence is controversial, and plenty of smokers live long life.” — China National Tobacco Company, in a letter to state bodies warning against imposing new anti-smoking regulations

Three years earlier, in response to a WHO conference on tobacco, CNTC wrote to government state bodies –– including the Central Communist Party Office –– to warn against imposing new anti-smoking regulations. The company noted that the tobacco industry was “the single highest tax earner in government,” and employed 100 million people around the country.

In the letter, which was provided to OCCRP by an industry expert and has not previously been made public, China Tobacco even attacked the science proving that smoking is harmful.

“The health evidence is controversial, and plenty of smokers live a long life,” the company wrote.

“Unscientific anti-smoking publicity would not achieve the objective and would be misleading.” — Bopha Phorn, Nathan Jaccard (OCCRP), Sol Lauría (Concolón), David Tarrazona (Cuestión Pública), Mateo Yepes (Cuestión Pública), Lilia Saúl (OCCRP), Anna Myroniuk (Kyiv Post), Naira Hofmeister (The Intercept Brazil), Luiz Toledo (OCCRP), Owen Gagare (The NewsHawks), and Nhau Mangirazi (The NewsHawks) contributed reporting.

You may like