BRENNA MATENDERE

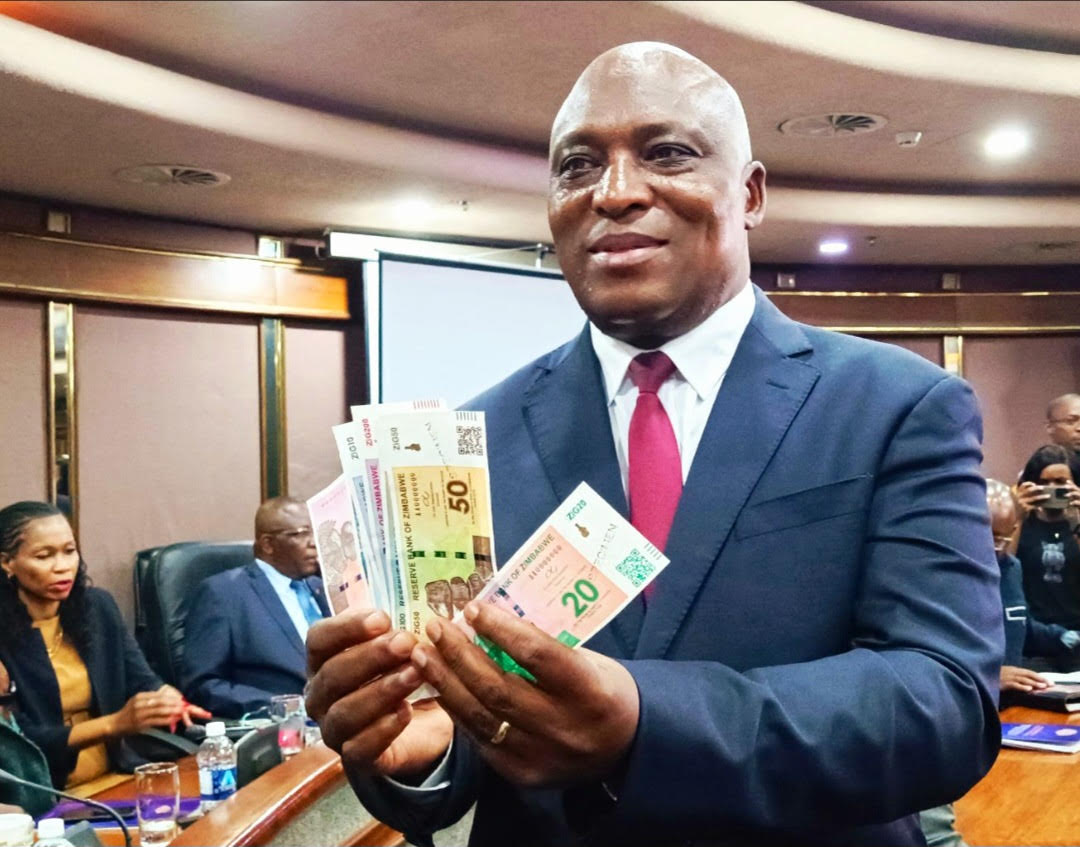

THE Reserve Bank of Zimbabwe (RBZ) under new governor John Mushayavanhu has laid to waste millions’ worth of the Zimbabwe Gold (ZiG) banknotes printed at a huge cost as they bore the signature of his predecessor John Mangudya which he did not want in circulation.

When Mushayavanhu introduced ZiG on 5 April, trading at US$1: 13.56ZiG to the United States dollar, there was a bunch of banknotes of the new currency already printed under his predecessor Mangudya.

That was done as part of preparations for the phasing out of the bond notes which had been introduced in 2016 before being converted into local currency in 2019 —10 years after the Zimbabwe dollar had been abandoned at the height of the country’s economic meltdown and hyperinflation.

That came with the advent of a new Government of National Unity after the 2008 elections fiasco.

The printed notes were worth millions, but had to be destroyed to remove those signed by Mangudya which Mushayavanhu did not want to mix with his own notes.

That is the reason the new ZiG notes took almost a month to introduce as the RBZ had to print again from scratch, which was a huge, cumbersome process given that the money paper material had been imported through third parties.

An RBZ official explained the process:

“When Mushayavanhu came in, there were already ZiG banknotes that were printed in large quantities and signed by Mangudya.

“Mushayavanhu was initially expected to replace Mangudya whose 10-year term at the RBZ was due to end on 30 April 2024.

“However, in a notice President Emmerson Mnangagwa brought forward his appointment in an official gazette: (It is hereby notified that His Excellency the President has, in terms of section 14 of the Reserve Bank of Zimbabwe Act (Chapter 22:15) appointed John Mushayavanhu as the Governor of the Reserve Bank of Zimbabwe for a period of five years beginning on March 28, 2024, and ending on March 27, 2029′).”

As a result, Mushayavanhu started more than a month earlier to take charge of the ZiG process.

RBZ officials say Mushayavanhu did not want the new currency to be associated with Mangudya in any way even though they were working together behind the scenes in a handover-takeover process, hence the already printed and signed notes had to be destroyed.

“The ZiG notes that were signed by Mangudya and bore his signature had to be destroyed as Mushayavanhu wanted a clean break from the past and not to be associated with bond notes or any other currency version issued in the past. For better or worse, Mushayavanhu’s attitude is that he is different from Mangudya and all his predecessors, which is why he says he will never print money, ‘not under my watch’.

“The amount of liquidity the market at the time was RTGS16.5 trillion (US$500 million).

“The proportion of cash in market liquidity varies depending on the market, asset class, and economic conditions.

“However, in stock markets cash typically accounts for a small percentage of overall liquidity, around 1%-5%.

“The majority is made up of electronic trades, margin accounts, and other forms of non-cash liquidity.

“In foreign exchange markets, the stock of cash is a much smaller component, around 1%-2%, as most transactions are settled electronically.

“Cash can be a larger proportion in bond markets, say around 10%-20% due to the nature of fixed-income instruments.

“In commodity markets, cash is largely significant, making up to between 20%-30%, especially in physical commodity markets like gold or oil.

“Cash is often a small percentage in the cryptocurrency markets; transactions are mostly settled electronically, but the exact proportion can vary depending on the specific market.

“Keep in mind these are rough estimates, and the actual proportion of cash in market liquidity terms varies significantly depending on various factors such as market conditions, trading volumes, and regulatory requirements.

“Now in this case, cash was about US$50 million in the market and 5% of that had been printed, probably US$5 million which means that the RBZ under Mushayavanhu destroyed or burnt banknotes worth that.”

Prior to that, Mnangagwa had hinted that the authorities would soon announce steps to halt the plunge of the Zimbabwe dollar, at the time the world’s worst performer against the United States dollar and other base currencies.

“We shall soon be announcing the introduction of our structured currency,” Mnangagwa said at his first cabinet meeting of the year in February in the capital, Harare. “The nation’s fiscal and monetary heads were working on a raft of policy measures to arrest price increases, stabilise the currency and encourage savings.”

At the time, the Zimbabwe dollar was on a free-fall amid currency volatility and exchange rate-driven surging inflation.

Subsequent to that, Finance minister Mthuli Ncube said:

“What the President announced is what we may call necessary policy forward guidance, which means that the leader is announcing that Zimbabwe is on a path to further reforms on its currency and monetary system, which is a good thing for getting everyone geared up to realise that this is an important issue.

“This is a quest for currency stability, but I’m still pleased that so far Zimbabwe has shown very strong growth.”

As a result, the RBZ had started printing ZiG notes in preparation for the introduction of the new currency, whose launch details were first reported by The NewsHawks.

An RBZ official explained the process:

“There was a liaison platform behind the scenes bringing together Mangudya and Mushayavanhu for a smooth transition. Mangudya started the process and hoped Mushayavanhu would continue from where he left, only to discover that his successor — coincidentally another John — was not interested in that. He wanted to draw a line and start afresh even though some ZiG notes had been printed. Mangudya had built some gold and cash reserves which he handed over to Mushayavanhu to ensure he started on stronger footing, but the issue of who signs the ZiG notes became a moot point.

“Mangudya thought there was nothing wrong with him signing some of them and Mushayavanhu some, with the ones signed by the former subject to be phased out from circulation gradually, but the latter wanted them out of the market before they were even formally introduced.

“That ensured Mushayavanhu launched ZiG without notes, forcing the country and market to wait for a month while they were being printed.

This also implied that millions of dollars’ worth of banknotes signed by Mangudya had to be burnt or destroyed at a huge cost.”

With effect from 5 April, banks were told to convert their Zimbabwe dollar balances into ZiG to “foster simplicity, certainty, and predictability in monetary and financial affairs”.

The process became complicated as ZiG notes only hit the market on 30 April.

The new currency was to co-circulate with other foreign currencies in the economy, but ZiG was not available for 25 days as the printed notes had been withheld, destroyed and were being reprinted.

Eventually, ZiG notes and coins were to be issued in denominations made up of ZiG 1, ZiG 2, ZiG 5, ZiG 10, Zig 20, ZiG 50, ZiG 100, and ZiG 200 distributed through normal banking channels.

Coins were to be introduced in due

course, but that was later abandoned.

ZiG banknotes were announced in eight denominations: 1, 2, 5, 10, 20, 50, 100, and ZiG 200.

However, a later announcement said the 1, 2, and 5 ZiG notes would instead be issued in coin form.

ZiG began circulating on 30 April 2024.

Officials say ZiG is backed by US$575 million worth of reserves: foreign currency, gold, and other precious metals.