THE 2021 National Budget should not be a routine fiscal ritual—it sets the template for aligning economic activity with the National Development Strategy (One)(NDS1), set to run 2021-2025.

Brett Chulu

The strategic context of the 2021 National Budget needs to be teased out.

The NDS1 is the successor to the Transitional Stabilisation Programme (TSP) (October 2018 to December 2020). The NDS1 will be followed by the NDS2 (2020-2026). The TSP, NDS1 and NDS2 are meant to be three sequenced strategic plans aimed at attaining Vision 2030 envisaged to drive Zimbabwe from a low income to an upper middle-income economy by 2030.

Currently, an upper middle-income economy in 2021 is classified by the World Bank as one with a per capita Gross Domestic Product (GDP) of US$4 046 – US$12 535. Currently, Zimbabwe’s per capita GDP for 2020 is projected by the International Monetary Fund to be US$922. This represents a decline of 58% from the World Bank’s figure of per capita GDP of US$ 1 464 for Zimbabwe for last year (2019). This means during the TSP period Zimbabwe fell from lower middle-income status (US$1 035 – US$4 045)) to low income economy (per capita GDP of less than US$1 035). This economic parameter of an economy that shows we will start the NDS1 as low-income economy is the starting point, a baseline the 2021 National Budget should invest attention in.

Strategic budget

At the time of writing this article, the NDS1 had not been published. The views on the forthcoming budget are based on an independent analysis and projections of economic parameters done by the writer. Best practice in terms of strategic planning is to have a budget tied to strategic activities (initiatives that drive the intended strategy).

Through the lenses of this approach, a budget is the monetary expression of the costs and incomes from strategic activities. Each activity must justify its inclusion on the basis that it contributes towards the intended strategy. It is this sort of thinking that must guide the formulation, execution and evaluation of the 2021 National Budget. Put more directly, the 2021 National Budget must be organised around strategic objectives, strategic targets (tied to strategic objectives), strategic activities/initiatives (tied to strategic objectives). It is the strategic activities that must determine the budget numbers, not the other way round. Our budget, if it is to contribute towards the attainment of an upper middle-income target by 2030, it cannot be an exercise in rationing collectible revenues from the fiscus to departments -it will cease to be strategic if it were to do so. Hard choices will have to be made. Strategy is built around choices, the very practice of economics of allocating scarce resources to chosen activities. Strategy goes a step further – it calls forallocation of scarce resources to strategic activities. I will be gravely disappointed if our 2021 National Budget is not organised around strategic objectives for NDS1.

Integration and alignment

Before the NDS1 is launched, we already have a challenge. We already have three sectoral strategies in place launched by three key portfolios, namely agriculture, mining and industry. The agriculture ministry launched the Agriculture and Food Systems Transformation strategy this month. The strategy is planned to run between 2020 and 2025. The mining ministry launched the US$12 billion strategy in October 2019 and is expected to run until 2023. From the industry portfolio, we have the Zimbabwe National Industrial Development Policy (2019-2023). With the exception of the agriculture strategy, the industry and mining strategies are not aligned with the time-frame of the NDS1.

The NDS1 and therefore the 2021 National Budget needs to make sure there is alignment with

these three sectoral strategies, incidentally, the three most critical drivers of our future GDP growth. It means the agriculture, mining and industry strategies might need re-adjustment and harmonisation – the result of this integration and alignment msut be reflected in both the NDS1 and the 2021 National Budget. Here are some issues I picked from these three sectoral strategies that need to addressed. The recently launched agriculture strategy that seeks to raise national income from agriculture from US$5,2 billion to US$8,2 billion by 2025, raising the contribution of agriculture to 20% of GDP (target stated in the agriculture strategy).

This implies a nominal GDP of US$41 billion in 2025. To reach the target of an upper middle income economy in 2030, the economy must grow at a rate of 23,4% per year. The Southern African Development Community(Sadc)’s Macro-economic Policy Convergence signed in 2002 sets an inflation benchmark of 3%. Judging by the TSP inflation targets, the NDS1 is likely to set year-on-year inflation target within the 3%-5% band.

This implies that for the upper middle income economy target to be attained at the earliest in 2030, a real annual growth rate of 18,4% to 20,4% is required from 2021 to 2025. Thereafter, a real growth rate of 14%-17% will be needed. Going by the agriculture strategy assumptions, our economy will be US$26,3 billion in 2023, the year the mining strategy is expected to attain the US$12 billion target. The mining strategy, by implication, envisages mining contributing 45,6% to GDP. This means that mining and agriculture are expected to contribute a combined 72,2% to GDP. These numbers are not feasible.

This suggests significant misalignment in terms of assumptions and growth targets for the two sectors. The industry strategy set a growth target for manufacturing of 2% per year. It is not clear if it is growth in volume or value. What is more concerning is that the industry strategy does not have target for contribution of manufacturing to the GDP. It only cites that the contribution of manufacturing to GDP was 12,1% in 2017 and an average of 24% in the 1980s. Agriculture and mining are primary industries and their scope for growth will be limited after the initial ramp up envisaged by the two sectoral strategies. Manufacturing needs to take a significant share of contribution to GDP, taking advantage of the growth in agriculture. It is imperative that mining, agriculture and industry sit with Treasury to harmonise targets.

The budget will be of little strategic value if it is not based on harmonised strategies in key sectors.

Budget strategy role

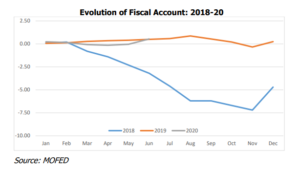

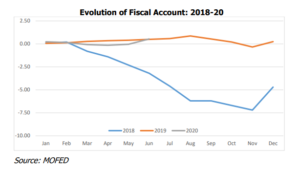

Once our growth numbers are harmonised, the 2021 National budget will serve as a rallying point of accountability for the key sectoral contributors. The direct influence of the budget on growth will be the setting of fiscal targets that are in harmony with monetary targets and policies support the envisaged growth. It is critical that budget deficits be set in line with the Sadc macro-economic policy convergence target of 2%-4%.

This will contribute immensely in curbing inflation driven by an inordinate increase in money supply. Fiscal and monetary policy in terms of inflation control must be harmonised so that our annual inflation tends towards the Sadc macro-economic convergence target of 3%. Low inflation is critical in the pricing of domestic loans and in the preservation of incomes for producers and consumers.

It is not meaningful to pursue per capita GDP targets if that growth does not result in improved standards of living and the ability of citizens to generate surpluses that will grow the pool for funds available for gross capital formation, critical to sustain economic growth. We need gross capital formation rates of 30%-35% of GDP in order to reach the growth numbers implied by the Vision 2030 per capita GDP target. It is not possible to reach the required capital formation rates if inflation is double digit. Taxation is a key factor in supporting economic growth. The 2021 budget needs to allow corporates to create more surpluses as well as increase the disposable incomes of individuals and their ability to contribute towards national savings.

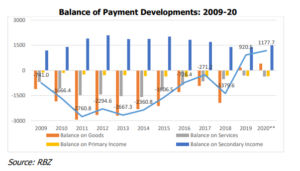

In terms of imports, further cuts in duty for importation of capital goods are imperative – agriculture, mining and manufacturing, as the key drivers of the initial growth, need support in reducing the costs of acquisition of capital goods. Duty on imports of consumptive goods and services substitutable by reviving local industry needs to be raised. Government expenditure needs to prioritise capital projects that support production. Water harvesting and irrigation development are critical. Power generation is critical too.

Treasury needs to use its intellectual capital to make proposals on creative methods to source funds for infrastructure development – in other words, treasury must deepen its advisory capacity. There is a lot of under-performing state assets such as idle state land and parastatals. Treasury can advise government and structure deals where investors snap up or lease whole or part of the assets in lieu of funding key infrastructure such as irrigation, renewable power (solar, biogas, wind) and roads. Harmony is key. Agriculture and industry strategies are aiming at rural industrialisation. Treasury should prioritise capital projects aligned to such strategic projects, for example. Tax cuts for importation of key components for renewable energy is imperative.

In terms of debt management, the 2021 National Budget needs to enter into a commitment to re-enter the IMF Staff Monitored Programme (SMP). Without the SMP, debt relief is not possible.

The 2021 national budget should become the convergence space for monitoring and reporting key growth risks – a national dashboard of sorts. It should act as report card for periodic performance of the National Development Strategy. This will help keep all stakeholders accountable. Risks to growth arise mainly from governance challenges, policy misalignment, lack of strategic foresight, leadership deficiencies, political instability, lack of professionalism and a lack of a culture of accountability. The budget review needs to be a strategy review. When variances from set growth targets are huge, questions need to be asked. For example, if the issue of tradable leases not addressed, agriculture growth contribution will be severely curtailed.

Our 2021 National Budget and subsequent budgets will have no strategic value if they are not an expression of the National Development Strategy. The quality of the National Development Strategy is essential–it determines how useful the budget will be in pushing the goal of Vision 2030.